How To Short A Stock On Thinkorswim App

Short Calls

For traders who believe a stock's price will fall or stay neutral, writing calls can be an effective strategy. Learn about two different types: covered calls and naked calls.

Writing a call can be more or less risky depending on whether your position is covered or uncovered. Either way, call writers typically believe the stock's price will either fall or stay neutral, leaving the option out-of-the-money and worthless.

You take less risk by writing a call on shares of a stock you already own, which is also known as writing a covered call. Instead of being forced to purchase shares in the secondary market if the option is exercised, you can deliver shares you already own. You receive a premium when you sell the call. If the call goes in the money prior to or at expiration, you will likely be assigned on your short call requiring you to sell your shares of stock at the option's strike price. If you end up selling your stock for a price higher than what you initially paid for it, you should end up with a net profit or at least reduce your overall net loss if you paid more for the shares than you sold them for. Covered calls offer some protection in a bear market, but it's limited to the premium received when you sold the call.

Uncovered, or naked, calls are much riskier. If you write an uncovered call that gets assigned, you will be required to deliver shares that you don't already own and will be responsible for buying them in the secondary market. Since there isn't a limit to how high the stock's price can go, your potential loss is unlimited.

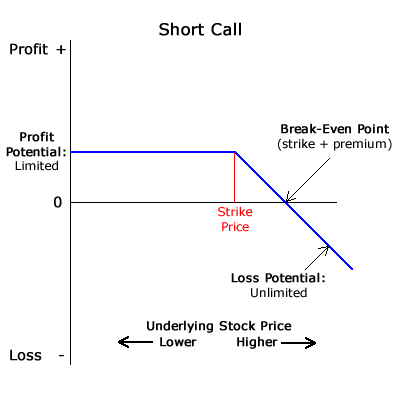

Short Call Graph

This illustration is hypothetical and does not reflect actual investment results, transaction costs, or guarantee future results.

In the graph shown here, the vertical (Y-axis) represents profit and loss, while the horizontal (X-axis) shows the price of the underlying stock. The blue line shows your potential profit or loss given the price of the underlying.

On Margin

Although you generally can't purchase options on margin as you can stocks, you'll need that ability if you want to write uncovered calls. Since uncovered calls expose you to more risk than other options strategies, your brokerage firm wants to make sure you'll have enough capital to meet your obligation should the option be exercised. You'll have to maintain the margin requirement, which is typically 20% of the underlying stock's worth minus the amount the option is out-of-the-money, though this amount cannot be less than 10% of the underlying security's value. If the assets in your account fall below the margin requirement, you'll receive a margin call and be required to add additional capital to meet the minimum or liquidate the position or positions to cover the shortage. Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance.

How To Short A Stock On Thinkorswim App

Source: https://www.tdameritrade.com.sg/options-strategies/short-calls.html

Posted by: gravesexcums.blogspot.com

0 Response to "How To Short A Stock On Thinkorswim App"

Post a Comment